- SparkNotes

- Posts

- The Race to Permit America’s Batteries in 2025

The Race to Permit America’s Batteries in 2025

We Looked at 16,000 Clues to the US Battery Landscape on Spark

Image: Energy Vault (PV Magazine)

Utility-scale batteries have become one of the fastest-growing segments of the U.S. energy market. At the surface, it seems like many state and federal policies are accelerating support for projects. However, upon closer inspection, the ground reality is that local governments paint a picture of complexity.

Spark analyzed over 16,000 BESS-related records, including zoning ordinances, permit filings, fire code updates, and moratoria, to identify where the U.S. is accelerating storage development and where it is pressing pause.

Planned BESS Installations in 2023 (Source: Visual Capitalist)

The National Picture

According to pv-magazine USA, U.S. energy-storage installations grew over 60% in a year to 10 GW in 2024. Solar grew 21% percent in the same period. The country now hosts more than 30 GW of operational grid-scale batteries with 184 GW in active development.

Where Projects Stall

Suburban density and political caution go hand in hand: Spark found that many of the most restrictive AHJs are in New York. Moratoria now cluster where land use is contested or governance is fragmented.

High Mentions of Moratoria for BESS

Rank | State / County |

|---|---|

1 | NY – Suffolk |

2 | NY – Westchester |

3 | NY – Nassau |

4 | NY – Putnam |

5 | NY – Niagara |

6 | CA – San Diego |

7 | IN – Pulaski |

8 | NY – Orange |

9 | WI – Kenosha |

10 | IA – Floyd |

Where the Work Is Happening

Spark’s dataset also surfaces the counties with the most administrative activity around BESS: hearings, permit filings, code revisions, moratoria, and rulemaking.

State | Top Counties (Ranked) |

|---|---|

California (CA) | San Diego • Imperial |

New York (NY) | Suffolk • Westchester |

Virginia (VA) | Charlotte • King George |

Michigan (MI) | Washtenaw • Clinton |

Texas (TX) | Galveston • Harris |

Illinois (IL) | Livingston • Champaign |

Massachusetts (MA) | Hampden • Worcester |

Washington (WA) | Klickitat • King |

Iowa (IA) | Floyd • Linn |

New Mexico (NM) | Bernalillo • Sandoval |

Administrative volume mirrors two poles of the energy map: population centers such as King County (WA), and renewables-heavy rural zones like Imperial (CA), Charlotte (VA), and Klickitat (WA). California, New York, and Virginia are some of the most procedurally active states in the country for BESS siting.

States With Less Friction

Several states show strong BESS permitting or zoning activity with less friction—evidence of faster-moving, more pragmatic regulatory systems.

High-Activity / Fewer-Moratoria States

Virginia (VA)

New Mexico (NM)

Oregon (OR)

Utah (UT)

Pennsylvania (PA)

Arizona (AZ)

What Developers Should Watch

Zoning remains a leading cause of delay. Many counties still lack explicit BESS land use categories, forcing planners to classify projects as industrial or special-use facilities.

Fire-code alignment is the next bottleneck: Many local governments pause battery storage approvals until they update their fire and building codes to include the newest safety standards. Two core references drive those updates:

NFPA 855: National Fire Protection Association Standard 855: Standard for the Installation of Stationary Energy Storage Systems. This sets rules for how batteries must be installed, spaced, ventilated, and protected from fire or explosion risks.

IFC 1207: International Fire Code, Section 1207: Energy Storage Systems. This integrates NFPA 855 principles into the broader fire code adopted by cities and counties, guiding local fire marshals on how to assess and permit storage facilities.

Developers can move faster by proactively considering two forms of documentation:

UL 9540A Test Report: Underwriters Laboratories Test Method for Evaluating Thermal Runaway Fire Propagation in Battery Energy Storage Systems. This lab test shows how a battery behaves in a failure scenario—whether heat, flame, or gas spreads, and how effectively it’s contained.

Emergency Response Plan (ERP): A document detailing site access routes, ventilation systems, fire-suppression features, and training for first responders.

Together, these materials demonstrate compliance with NFPA 855 and IFC 1207 even before local adoption, allowing some jurisdictions to approve permits ahead of schedule.

Community sentiment is the invisible variable. Public misunderstanding of thermal-runaway risk continues to fuel moratoria proposals.

The Strategic View

Spark’s analysis of 16,000 records shows different sides of America:

California and New York lead in policy development but may drag on execution.

Texas, Arizona, Nevada, and increasingly Virginia and New Mexico build fast, with fewer procedural layers.

With total storage expected to reach 65 GW by 2026, understanding where batteries are permittable rather than just profitable will determine who builds the backbone of the next-generation grid.

Explore the Insights Yourself

Today, users of Spark can access detailed, AHJ-level analytics on BESS permitting, zoning, and sentiment across every active county in the United States in minutes.

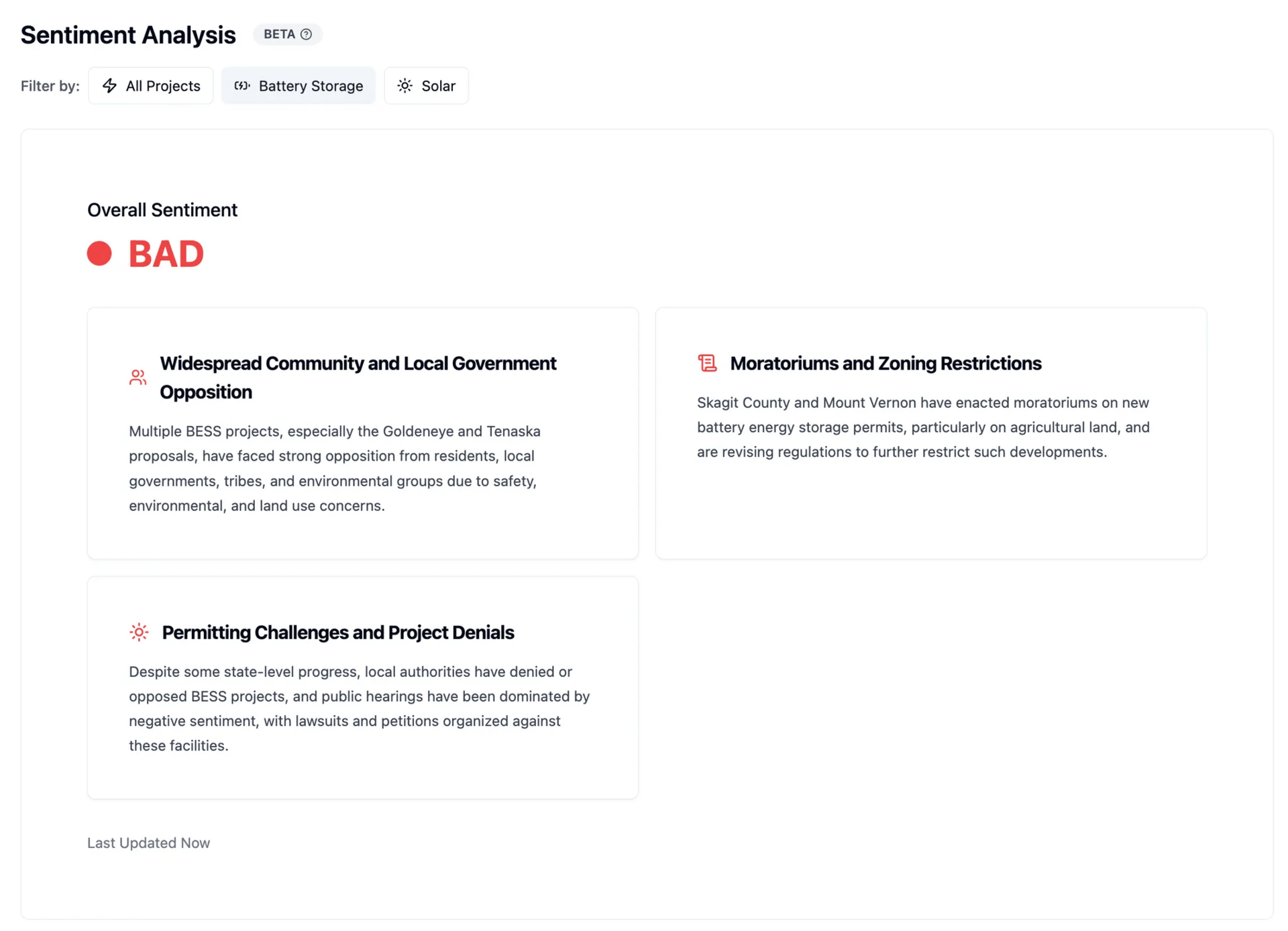

BESS-specific sentiment analysis

The BESS landscape is heterogeneous. Even within a single state, the regulatory landscape and local sentiment are shaped by several different authorities, and it is prudent to diligence each site thoroughly.

To explore how these insights and datasets can strengthen your siting and development pipeline, or inquire about our datasets, get in touch with our team.

BESS highlighted in sentiment, zoning, and moratoria